10 Oct 2023

Introducing WhatsApp Business to the insurance industry opens up exciting possibilities. WhatsApp has become the go-to communication platform for individuals and businesses. In this guide, we explore how insurance companies can tap into the potential of WhatsApp Business to improve their customer engagement and overall business activities.

One of the key advantages of WhatsApp Business is its secure and private messaging. Insurance providers can leverage this feature to create trust with their clients and provide them with real-time support. From easy quotes and claims for your clients to answering queries and sharing policy information, WhatsApp Business allows insurers to deliver a personalised and efficient service at scale.

WhatsApp Business also offers a range of automation tools that can streamline customer interactions. By setting up quick replies or automated messages, insurers can handle routine inquiries faster, freeing up their agents' time. King Price Insurance, for instance, used the Cue-powered live chat and chatbot solutions on WhatsApp, resulting in a 23% conversion rate for instant quotes.

This guide will dive into the various features and best practices for using WhatsApp for Business in the insurance industry. So, whether you are a small insurance agency or a large multinational insurer, this guide will help you unleash the full potential of WhatsApp Business and enhance your customer experience.

How insurance businesses can use WhatsApp Business

WhatsApp Business is a versatile tool that can transform the way the insurance industry operates. From insurance quote chatbots to streamlining policy renewals and providing real-time customer support. Let's explore how WhatsApp can improve your insurance operations.

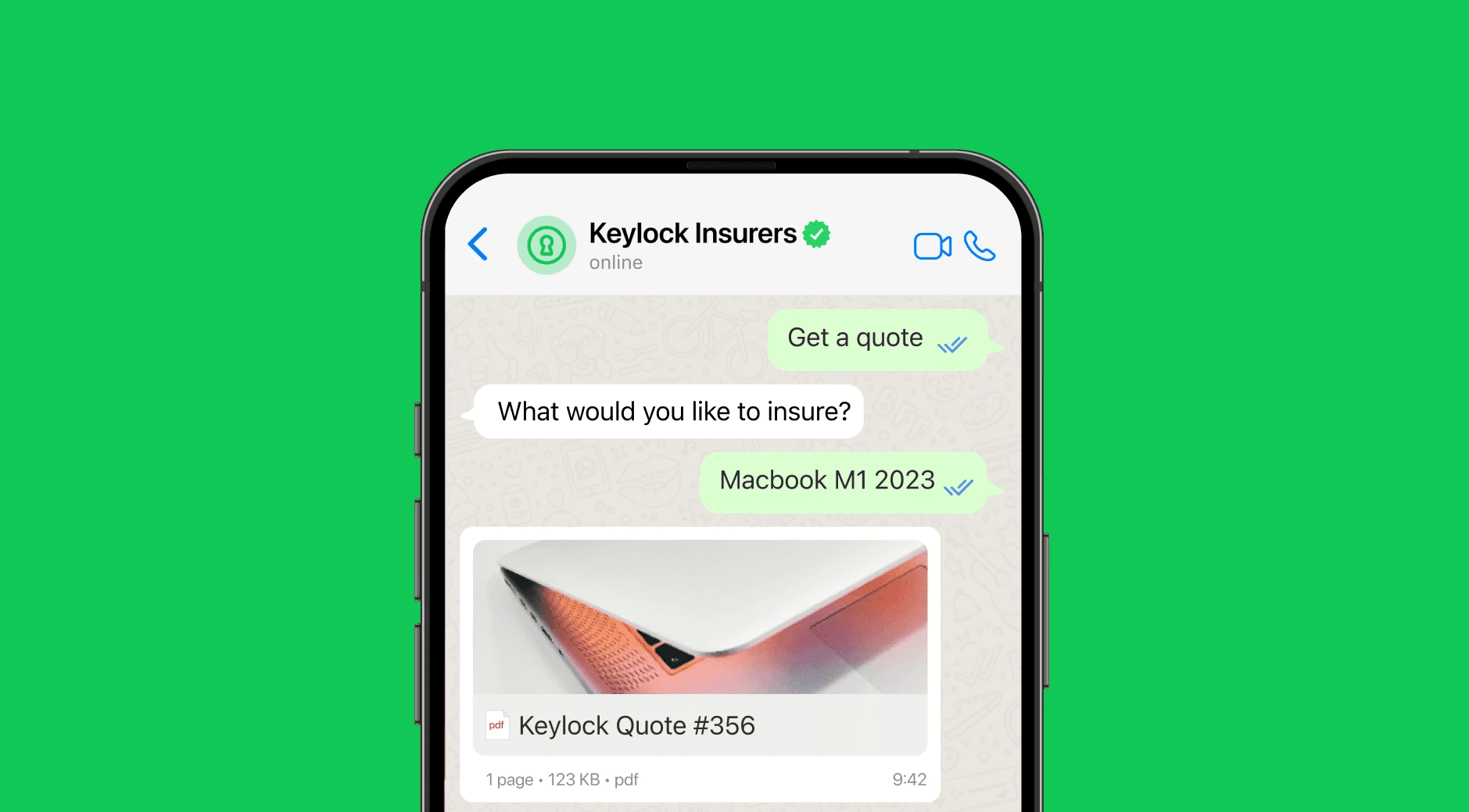

Insurance quote chatbots

Improve efficiency and response times with automated chatbots that quickly generate insurance quotes tailored to your customers' needs.

Insurance claim chatbots

Simplify the claims process with chatbots that guide customers through the necessary steps, ensuring a faster and smoother experience.

Insurance policy renewals

Send automated reminders and personalised messages to policyholders for hassle-free renewals, reducing lapses and increasing customer retention.

Surveys

Gather valuable insights from both customers and brokers through surveys. Customise surveys to collect feedback on service quality and user experience.

Notifications

Insurance businesses can use broadcast messages to provide timely information on weather warnings, disasters, and important updates, helping you keep customers informed and safe.

Customer support

Improve customer support by offering real-time assistance through live chat, allowing quick issue resolution, and improved customer satisfaction.

With WhatsApp Business, you can improve customer service, boost operational efficiency, and increase client satisfaction. In addition to simple messaging, the solution offers a comprehensive approach to modernising and elevating the approach to client interactions in the insurance industry.

WhatsApp Business vs. traditional insurance communication channels

The insurance industry has traditionally relied on conventional communication channels like phone calls, emails, and postal services. WhatsApp Business has emerged as a modern alternative that offers a unique set of advantages. Let's compare WhatsApp Business with traditional insurance communication channels to understand why it's becoming the preferred choice for insurers:

Speed and accessibility

WhatsApp Business

Provides instant communication.

Allows clients to reach out 24/7.

Messages are accessible on smartphones, making it convenient for clients.

Automation tools

Traditional channels

Often involves delays due to office hours.

Limited accessibility outside of working hours.

Postal services require additional time for delivery.

Customers tend to grow impatient

Cost Efficiency

WhatsApp Business:

Messages are sent digitally, reducing phone call expenses for customers.

Eliminates the need for paper-based communication, reducing postage and printing costs.

Traditional channels:

Phone calls can result in higher bills.

Printing and sending documents via postal services incur additional expenses.

Customer engagement

WhatsApp Business:

Offers personalised and interactive communication.

Allows for immediate responses to queries and concerns.

Traditional channels:

Typically involves one-way communication.

Delayed response times can lead to frustration.

Claim processing

WhatsApp Business:

Simplifies claim submissions through file sharing.

Provides real-time updates on claim statuses.

Traditional channels:

Often require clients to visit offices or send documents by post or email.

Updates on claim statuses may take longer.

Data security and compliance

WhatsApp Business:

Prioritises data security

Ensures compliance with data protection regulations like GDPR.

Traditional channels:

Traditional methods sometimes can make it more difficult to implement effective compliance controls, which can result in inefficiencies and human error

Customer retention

WhatsApp Business:

Facilitates ongoing engagement, enhancing client loyalty.

Offers a direct channel for policy renewal reminders.

Convenient channel for customers

Traditional channels:

Client interactions are typically limited to policy issuance and claim processes.

Policy renewal reminders may be less frequent or less personalised.

Traditional communication channels have served the insurance industry well for decades, but WhatsApp Business represents a significant leap forward in terms of efficiency, accessibility, and customer engagement. Its instant, cost-effective, and interactive nature aligns with the evolving expectations of today's clients.

Leveraging WhatsApp Business for sales and lead generation

WhatsApp Business offers insurance providers a powerful tool to enhance sales and generate leads efficiently. By using its features strategically, insurers can provide personalized assistance, address customer queries promptly, and ultimately boost customer satisfaction and loyalty.

Chatbots for lead generation

Chatbots can be a valuable addition to your sales strategy. They can capture and qualify leads, answer basic inquiries, and even generate insurance quotes for potential customers. This automation not only saves time but also helps in identifying and nurturing prospects effectively.

Live chat for real-time sales support

Live chat, along with its associated features, empowers agents to engage with customers in real-time. During the sales process, this live interaction can be a game-changer. Agents can provide tailored quotes, offer expert advice, and guide customers through the decision-making process efficiently.

Quick replies for efficient query handling

Quick replies are essential tools for ensuring a smooth customer journey when nurturing a lead. Insurers can create predefined responses for common queries, allowing them to handle inquiries efficiently. This not only saves time but also guarantees that customers receive consistent and accurate information.

Best practices for using WhatsApp Business in the insurance industry

WhatsApp Business offers insurance providers a range of best practices to enhance their operations, from customer support to sales and lead generation. In the insurance sector, where effective communication is crucial, adopting these practices can lead to successful outcomes.

Proactive engagement with broadcasts

One of the best practises is to use broadcasts to prompt your clients to engage. By sending bulk messages that initiate conversations with potential customers, insurers can provide information about insurance policies, address frequently asked questions, and guide customers through the initial stages of the sales process.

Streamlined customer engagement

WhatsApp Business allows insurers to streamline their customer engagement. By offering policy information, claim forms, and other crucial documents through WhatsApp's multimedia capabilities, insurers can simplify the process for clients and prospects. The ability to share images, videos, and documents enhances transparency and makes the customer journey more efficient.

Real-time support

A best practise for insurers is to use WhatsApp Business for real-time support during critical moments in the customer journey. Whether it's addressing claims, providing quick quotes, or assisting with policy renewals, the platform ensures that customer support remains accessible and responsive when it's needed the most.

Frequently asked questions

What are the key advantages of using WhatsApp Business for insurance communication?

WhatsApp Business offers instant and accessible communication, cost efficiency, personalised customer engagement, simplified claim processing, and robust data security. It allows insurers to improve customer satisfaction, streamline operations, and provide real-time updates.

Can WhatsApp Business be used for critical insurance transactions and claim submissions?

Yes, WhatsApp Business is a versatile tool that facilitates critical transactions and claim submissions. Clients can submit documents, photos, and updates instantly through the app, expediting processes and improving the customer experience.

Is WhatsApp Business secure for handling sensitive insurance information?

WhatsApp Business prioritises data security with end-to-end encryption, ensuring the confidentiality of sensitive information. It complies with data protection regulations like GDPR, providing a secure platform for insurance communication.

How does WhatsApp Business contribute to client retention?

WhatsApp Business fosters ongoing engagement with clients through personalized communication. It enables insurers to send policy renewal reminders, updates, and information, ultimately building trust and enhancing client loyalty.

Is WhatsApp Business replacing traditional insurance communication channels entirely?

While WhatsApp Business is transforming insurance communication, it doesn't necessarily replace traditional channels entirely. It complements existing channels and offers an efficient, client-centric alternative, allowing insurers to choose the most suitable communication method for different scenarios.

Get started with WhatsApp Business

WhatsApp Business isn't just a communication tool; it's a gateway to a brighter, more accessible future for the insurance industry. By introducing WhatsApp Business and partnering with service providers like Cue, you're not only meeting but exceeding customer expectations and contributing to the future of insurance communication.

As the insurance industry evolves, Cue serves as your trusted partner in getting the most out of WhatsApp Business. Our expertise ensures a smooth transition, from setting up WhatsApp Business to making full use of its features. Request a demo today!