31 Jul 2024

It's policy renewal season, and your team is drowning in a sea of email chains, ignored phone calls, and forgotten renewal notices. Your policyholders are slipping away faster than sand through an hourglass, and your retention rates are giving you nightmares.

But what if there was a way to simplify the insurance renewal process for your teams and policyholders? With WhatsApp, insurance businesses can reach policyholders instantly, remind them effortlessly, and make renewals a smooth process.

In this blog, we'll cover:

Why WhatsApp works for insurance renewals

How to overcome common insurance industry headaches with WhatsApp

How to send insurance renewal reminders that actually work

Benefits of WhatsApp for insurance

WhatsApp is more than just a messaging app; it allows insurance businesses to build lasting relationships with their policyholders. Here’s why it’s perfect for insurance renewals

Instant connection

WhatsApp's instant messaging capability and 98% open rate mean your renewal reminders land in your policyholders' hands quicker than a broker can say "claim denied."

Easy quoting

Gone are the days of boring text-only reminders. With WhatsApp, you can easily and quickly send insurance quotes. Insurance providers can send detailed quotes quickly, including policy breakdowns and coverage explanations.

Instant, two-way communication

Unlike traditional channels, WhatsApp allows for instant back-and-forth. Policyholders can ask questions, request changes, or even complete their renewal right in the chat. It's like having a personal insurance broker in their pocket.

Secure communication

WhatsApp's end-to-end encryption ensures that sensitive policyholder information remains secure, an essential feature for maintaining trust in the insurance industry.

Smooth integration

WhatsApp can be integrated with existing customer relationship management (CRM) systems and other business tools. This integration allows for a more holistic view of customer interactions and enables more personalised communication.

Common insurance renewal challenges

Let's face it, renewals can be a headache. Customers forget, policies lapse, and revenue takes a hit. WhatsApp can help address the following pain points:

Low renewal rates

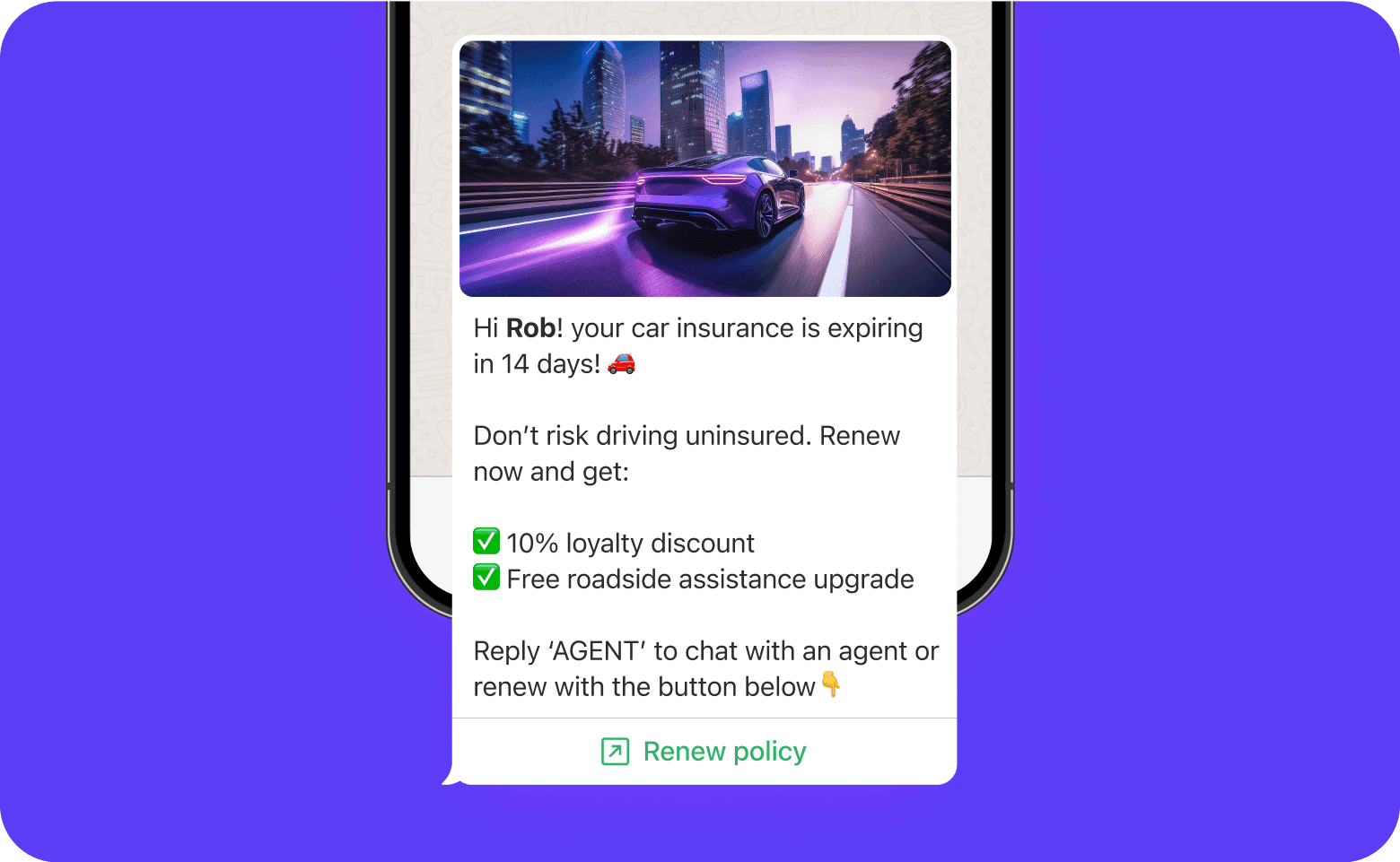

Timely reminders and personalised offers, delivered directly to customers via WhatsApp, can significantly boost renewal rates. By making the renewal process convenient and engaging, you can reduce the likelihood of policy lapses.

Inefficient renewal processes

Insurance providers can automate routine tasks like sending reminders, collecting payments, and providing policy information with WhatsApp chatbots, streamlining the process for both you and your customers.

Poor customer experience

Traditional renewal methods can be impersonal and frustrating. WhatsApp offers a more engaging and interactive experience, building stronger customer relationships.

Increased competition

With numerous insurance options available, retaining customers is crucial. WhatsApp allows you to differentiate your business by providing exceptional customer service and personalised offers.

Customer procrastination

Even when reminded, customers often put off renewing their policies until the last minute or after their policy has lapsed. Insurance businesses can create a sense of urgency through WhatsApp. Send countdown reminders, highlight the risks of letting a policy lapse, and offer limited-time renewal incentives.

How to send insurance renewal reminders with WhatsApp

24/7 renewals with WhatsApp chatbots

Insurance businesses can set up automated chatbots to handle initial renewal reminders, answer FAQs, and guide policyholders through the renewal process.

Create a chatbot flow that sends out initial reminders, prompts policyholders to review their policy details, and directs them to the appropriate next steps in the renewal process.

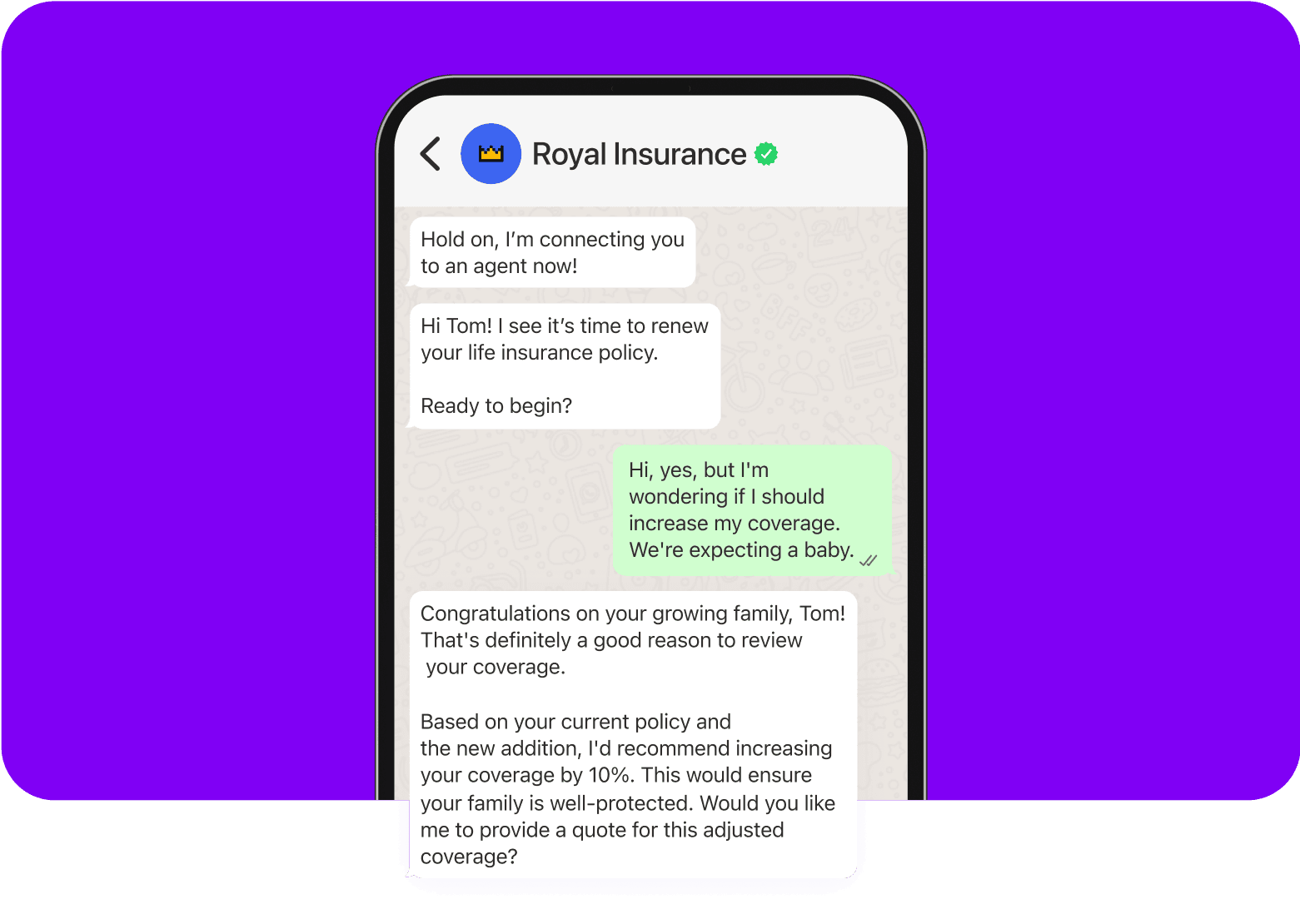

Personal renewal reminders with WhatsApp live chat

Insurance businesses can have their customer service team available for real-time conversations about renewals, addressing specific questions and concerns. Chatbots can route customers to live agents if they have additional questions.

Mass renewals with WhatsApp broadcasts

Insurance providers can send targeted renewal reminder messages to segments of their policyholder base. Create different message templates for various policy types, customer longevity, or risk profiles.

Best practices for WhatsApp insurance renewals

To maximise the effectiveness of your WhatsApp renewal reminders, consider these best practices:

Timing matters

Timing is everything in insurance. Start your renewal campaign early, but not so early that customers forget about it. Here's a winning formula:

First reminder: 30 days before expiry

Second reminder: 15 days before expiry

Final reminder: 5 days before expiry

Last chance: 1 day before expiry

This approach keeps your policy at the top of your customer's mind without feeling like that friend who texts you every 5 minutes.

Personalisation is key

Nobody likes to feel like just another policyholder. Use your customer data to personalise messages. Include their name, policy type, expiration date and any loyalty rewards or discounts they're eligible for.

Balancing chatbots and humans

Chatbots are great for handling initial reminders and simple queries but sometimes people just want to talk to a real person. It’s important to know when to bring in the human touch. Set up custom flows to transfer chats to live agents for complex policy changes, high-value renewals and customers expressing dissatisfaction.

Make renewals as easy as possible

The easier you make it to renew, the more likely customers are to do it. Consider one-click renewal options for policies with no changes that allow customers to renew within the chat or receive a direct external URL to their policy information. The goal is to make renewals easier than deciding what to watch on Netflix.

Stay compliant

Get explicit consent from your policyholders to communicate via WhatsApp, provide clear opt-out instructions in every message and make sure that all communications comply with insurance regulations and data protection laws. Being compliant is like wearing a seatbelt – it might not be exciting, but it'll save you a world of trouble.

Test, learn and optimise

Don't set it and forget it. Continuously test different message formats, timing sequences and call-to-actions. Use A/B testing to see what resonates best with your customers. Maybe they prefer emojis, or perhaps they're more into formal language.

Provide value beyond reminders

Don't just ask for renewals – offer something in return like tips for reducing premiums, information about new coverage options and general insurance education. By providing value, you're not just an insurer – you're a trusted advisor.

Beyond renewals: Addressing common insurance challenges

Renewals mean you have happy customers who want to continue with their policy. But how do you keep existing policyholders throughout their coverage, and how do you attract new policyholders?

Call centre wait times

Long wait times in call queues often lead to customer frustration and dissatisfaction. WhatsApp reduces call volumes by offering self-service options and instant chat support.

Claims processing

Complex claim processes and a lack of human engagement can make filing claims a daunting task for policyholders. WhatsApp chatbots offer 24/7 self-service for simple claims, while live chat provides a human touch for complex cases.

Lead leakage

Potential customers often drop off due to complicated forms and slow response times. WhatsApp improves lead capture and conversion through conversational interfaces, quick response times to maintain engagement and a seamless handover from chatbots to live agents for high-value leads.

Identify cross-selling opportunities

Insurance businesses can analyse customer data to identify potential upselling and cross-selling opportunities to offer additional or upgraded coverage to existing customers

Streamline insurance renewals with WhatsApp

Insurance businesses have reported up to a 5x increase in response rates since switching to WhatsApp. With WhatsApp, you're not just sending reminders; you're opening a two-way street to better customer relationships, higher retention rates, and smoother operations.

By leveraging WhatsApp chatbots, live chat, and broadcasts, you're not just keeping up with the times – you're setting the pace for the future of insurance communication.